boulder co sales tax return

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The Boulder sales tax rate is.

DR 0235 - Request for Vending Machine Decals.

. Property Data. Businesses located in the Center Fee districts sales tax rate is 175 and is in addition to the district fees. Boulder County enacts Stage 1 fire restrictions News release.

Claiming credit for other city state or county tax on line 8. Taxes-Consultants Representatives Tax Return Preparation Financial Services. In 2007 voters approved an extension of the sales tax through 2024.

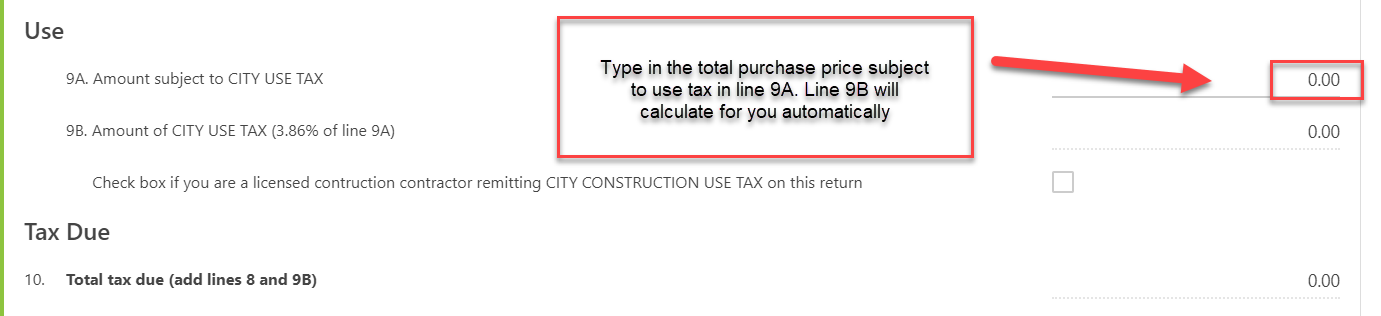

The Boulder County sales tax rate is. If you have more than one business location you must file a separate return in Revenue Online for each location. Not including all taxable purchases materials and other tangible personal property in the taxable amount on line 4.

Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax. Sales tax returns are due the 20th of the month following the month reported. 13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales.

This is the total of state county and city sales tax rates. Name A - Z Sponsored Links. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Boulder CO.

If you cant find what youre looking for online contact Sales Tax staff at salestaxbouldercoloradogov. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations. Taxes-Consultants Representatives Tax Return Preparation Bookkeeping.

File Online for Business Owners Available to businesses who received a postcard in lieu of a full declaration Deadline for filing declarations. Sales tax returns are due the 20th of the month following the month reported. Sales Tax in Boulder CO.

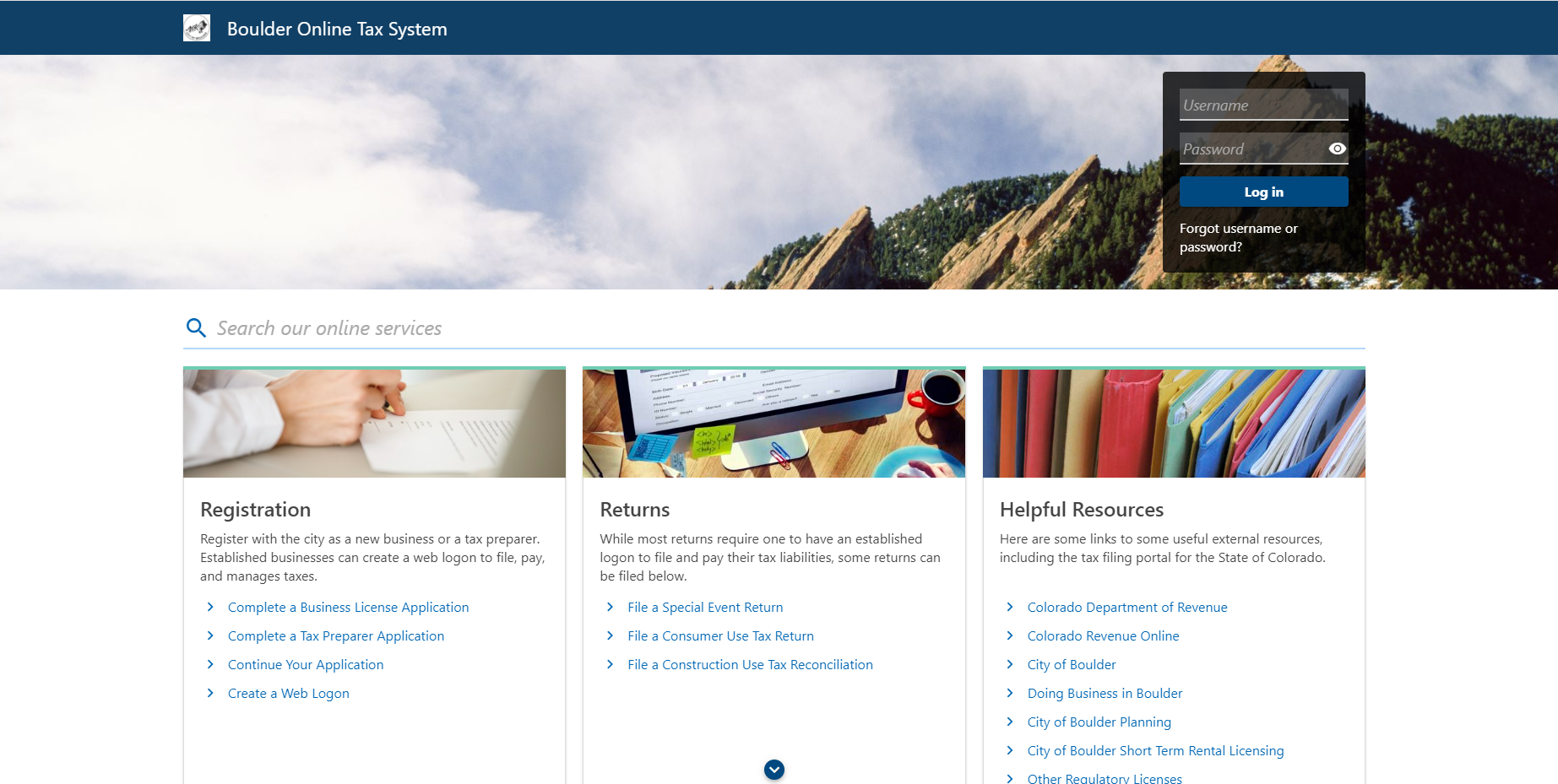

Visit the Boulder Online Tax System Help Center for additional resources and guidance. New for 2022 tax yearBoulder County is using a new Online BPP Filing system. Claiming credit for all permit fees and taxes on lines 6 and 7.

To review the rules in Colorado visit our state-by-state guide. There are a few ways to e-file sales tax returns. See reviews photos directions phone numbers and more for Sales Tax Calculators locations in Boulder CO.

In 2001 the voters of Boulder County passed a ballot issue that allowed for a 01 percent one cent on a 10 purchase countywide transportation sales tax. Sales tax returns may be filed quarterly. The Colorado sales tax rate is currently.

DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. 6 rows For information related to specific tax issues for state county or RTD please contact the. Sales Of Taxes in Boulder CO.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The Colorado state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v.

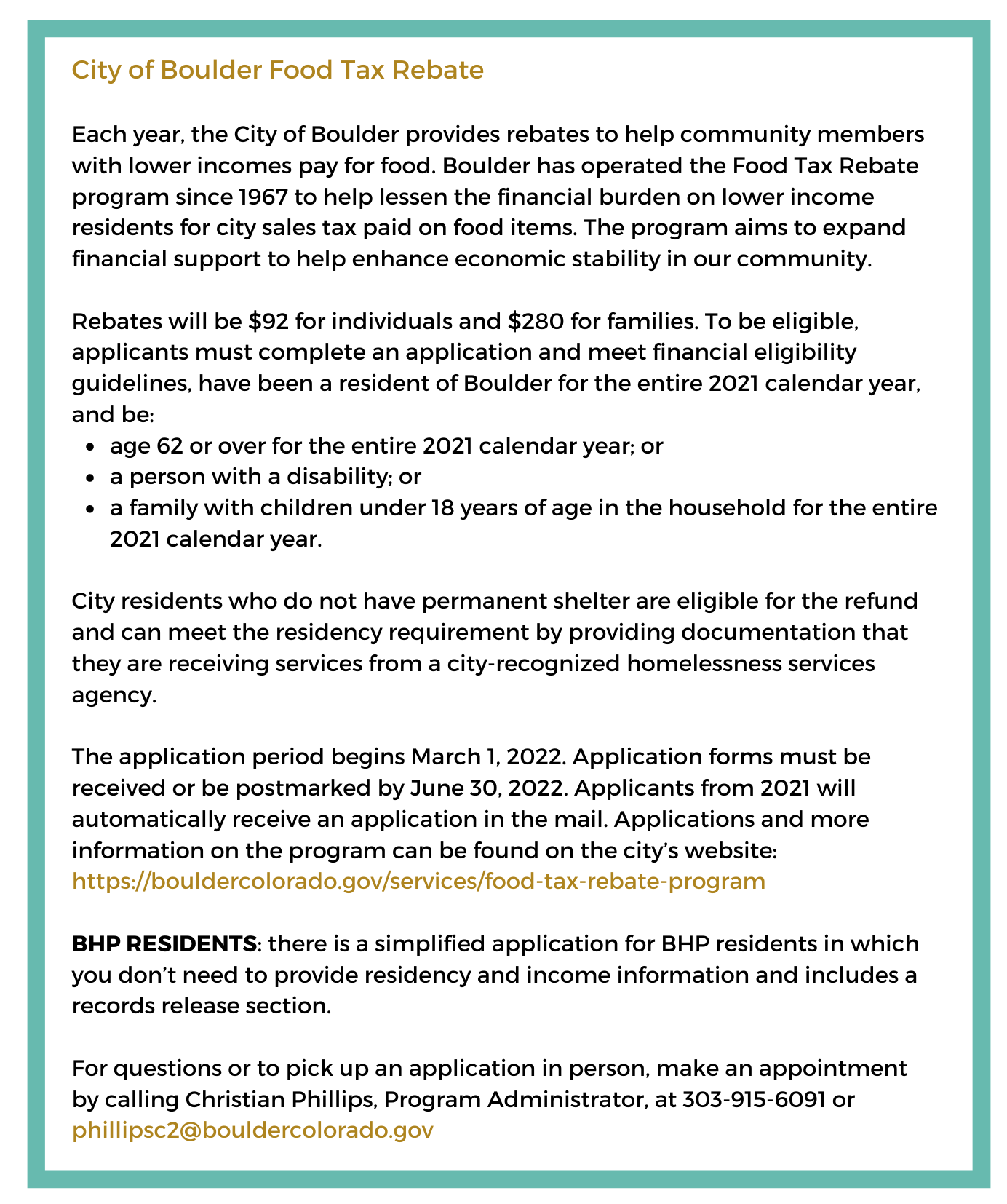

Bedell Associates PC. The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

The City of Lovelands sales tax rate is 30 combined with Latimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. The Transportation Sales Tax helps fund. Sent direct messages to Sales Tax Staff.

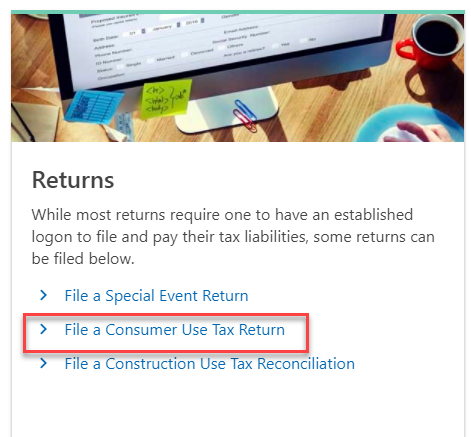

The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. DR 0154 - Sales Tax Return for Occasional Sales. Use Boulder Online Tax System to file a return and pay any tax due.

Sales Tax Calculator of 80303 Boulder for 2019 The 80303 Boulder Colorado general sales tax rate is 8845. If the 20th falls on a holiday or a weekend the due date is the next business day. Name A - Z Ad Jackson Hewitt Tax Service.

Under 300 per month. 3223 Arapahoe Avenue 305. YEARS WITH 720 398-0115.

All payments of Boulder County sales tax should be reported through CDORs Revenue Online portal or through forms found at. Complete a Business License application or register for a Special Event License. Common Problems with Reconciliation Returns.

1834 Main St Ste 7 Longmont CO 80501. Filing frequency is determined by the amount of sales tax collected monthly. Automating sales tax compliance can help your business keep compliant with.

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item. 13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. A tax return must be filed even if there is no tax due.

Returns must be postmarked on or before the due date to be considered on time. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The city use tax rate is the same as the sales tax rate.

Has impacted many state nexus laws and sales tax collection requirements. YEARS IN BUSINESS 877 514-4732. To start the filing process filers must first register their contact details using the link above.

If the 20th falls on a holiday or a weekend the due date is the next business day. Website Contact Us Directions More Info. See reviews photos directions phone numbers and more for Ecommerce Sales Tax locations in Boulder CO.

For additional e-file options for businesses with more than one location see Using an. Sales tax returns may be filed annually. Annual returns are due January 20.

15 or less per month. The minimum combined 2022 sales tax rate for Boulder Colorado is. CR 0100AP - Business Application for Sales Tax Account.

File online tax returns with electronic payment options. Please remember Boulder County taxes are paid to the Colorado Department of Revenue CDOR. The County sales tax rate is.

The combined rate used in this calculator 8845 is the result of the Colorado state rate 29 the 80303s county rate 0985 the Boulder tax rate 386 and in some case special rate 11. The minimum combined 2022 sales tax rate for Boulder County Colorado is 499. Sales Tax Calculator of 80303 Boulder for 2019 The 80303 Boulder Colorado general sales tax rate is 8845.

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business.

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales And Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

It S Tax Season Tax Credit Information And Free Tax Preparation With Efaa Efaa

How To Qualify For Tax Deductible Moving Expenses Moving Expenses Tax Deductions Moving

Construction Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Taxes In Boulder The State Of Colorado

Boulder Online Tax System Help Center City Of Boulder

Short Term Vacation Rental Checklist How To Create A Short Term Vacation Rental Checklis Rental Agreement Templates Business Plan Template Checklist Template

Sales Tax Campus Controller S Office University Of Colorado Boulder